2023 Army Retirement Pay - According to the Social Security Administration (SSA), the 2023 Cost of Living Adjustment (COLA) will be 8.7%. This will significantly increase the 2023 VA disability rate and monthly Veteran Compensation.

Each year, the Social Security Administration (SSA) sets the cost of living adjustment (COLA) update based on the city's wage income and the rate of increase in the consumer price index for office workers (CPI-W). CPI-W measures changes in the price of goods and services over time.

2023 Army Retirement Pay

After the Bureau of Labor Statistics (BLS) calculates the monthly CPI-W, SSA pulls data for the third quarter of the current year from the third quarter of the previous fiscal year (that is, July, August, and September). , to determine the COLA. following year.

Retiree And Survivor Pay Dates

The Senate then passes a new law that allows for an increase in the cost of living for veterans. The Veterans Administration (VA) will adjust a veteran's monthly benefit based on the updated cost of living. This usually increases benefits for veterans each year.

His COLA increase of 1.6% in 2020 slightly increased veterans' benefits. The 2020 VA wage rate went into effect on December 1, 2019, and veterans began receiving their newly adjusted benefits on December 31, 2019.

COLA growth in 2021 is 1.3%, a slight decrease from the previous year. This low rate is partly due to the impact of the COVID-19 pandemic on economies around the world. Veterans were still seeing increases in Veteran Disability Benefits as of December 1, 2020.

A 5.9% increase in COLA in 2022 has significantly improved performance from December 1, 2021.

Va Disability Pay Rates

Following the announcement of CPI-W for the second quarter of 2022 (April, May and June), SSA has set the official COLA 2023 at 8.7%. In the new year, COLA will see his biggest increase since 1981.

Prior to this announcement, projections from reliable sources provided the veteran with a frame of reference for the monthly veteran disability benefits she may receive in 2023. For example, the nonpartisan group The Senior Citizens League predicted that COLA could reach 9.6% for him in 2023.

Additionally, the BLS previously calculated the consumer price index (CPI-U) for all city consumers for the year ending July 2022 at 8.5%. CPI-U is a measure of changes in retail prices that affect all urban consumers and is a more popular indicator than CPI-W. It provided a glimpse of how quickly prices for consumer goods and services have risen over the past year.

Yes, the veteran will see a significant increase in her monthly disability benefits in 2023. If the VA applies her 2023 COLA to disability benefits, the veteran's December increase of 8.7% will be reflected in her monthly salary. The 2022 adjustment has already seen him grow by a significant 5.9%, but the 2023 adjustment is even bigger.

Military Retirement Gifts Retirement Party Decorations Air

An 8.7% increase in COLA would mean that a veteran with a 100% disability rating and no dependents would have added $289.89 to his disability benefits for a total of $3,621.95 per month. By comparison, her current rate for 2022 for a 100% disabled veteran is her $3,332.06.

The 2022 wage rate can be used as a basis to calculate her VA disability benefit estimate for 2023. Multiply her 2023 COLA of 8.7% by the 2022 allowance rate and add that figure to the rate. This adjusted number is the monthly VA payment for 2023.

The wage rates in this table reflect wage changes over the years based on her single veteran with no dependents.

A veteran with a total disability rate of 30% or more and who has at least one eligible dependent of hers is eligible for additional coverage. Eligible dependents include:

Physician Salary + Benefits

Veterans receive different wage rates depending on the type and number of dependents. To determine your 2023 tax rate, see her 2023 VA salary table based on dependent status below.

The numbers below have been adjusted using the 8.7% COLA from the 2022 VA Disabled Pay Table. The amount displayed in each field represents the veteran's monthly compensation based on a combination of the veteran's disability rating and dependency status.

It's important to note that a veteran with a score below her 30% is not eligible to receive additional dependent coverage. A 10% rated veteran will be paid $165.92 monthly, and a 20% rated veteran will be paid $327.99 monthly.

The veteran should receive her December 1, 2022 updated benefits after the VA adjusts disability rates accordingly. These changes will be reflected in veterans' monthly payments at the end of the month (i.e. December 30, 2022).

Your 2022 Guide To Military Benefits

If you have a service-related illness and the VA has denied you disability coverage, Chisholm & Kilpatrick LTD may be able to help. CCK's experienced and knowledgeable veteran attorneys have decades of experience representing veterans before the VA and the Court of Veteran Claims Appeals (CAVC). Contact CCK today at 800-544-9144 for a free consultation. The 2023 cost of living adjustment is her 8.7% for Social Security checks, Veterans Disability Benefits, and other public pension and benefit programs.

Advertiser Disclosure: Opinions, reviews, analyses, and recommendations are solely those of the authors. This article may contain links from advertisers. See our Advertising Policy for more information.

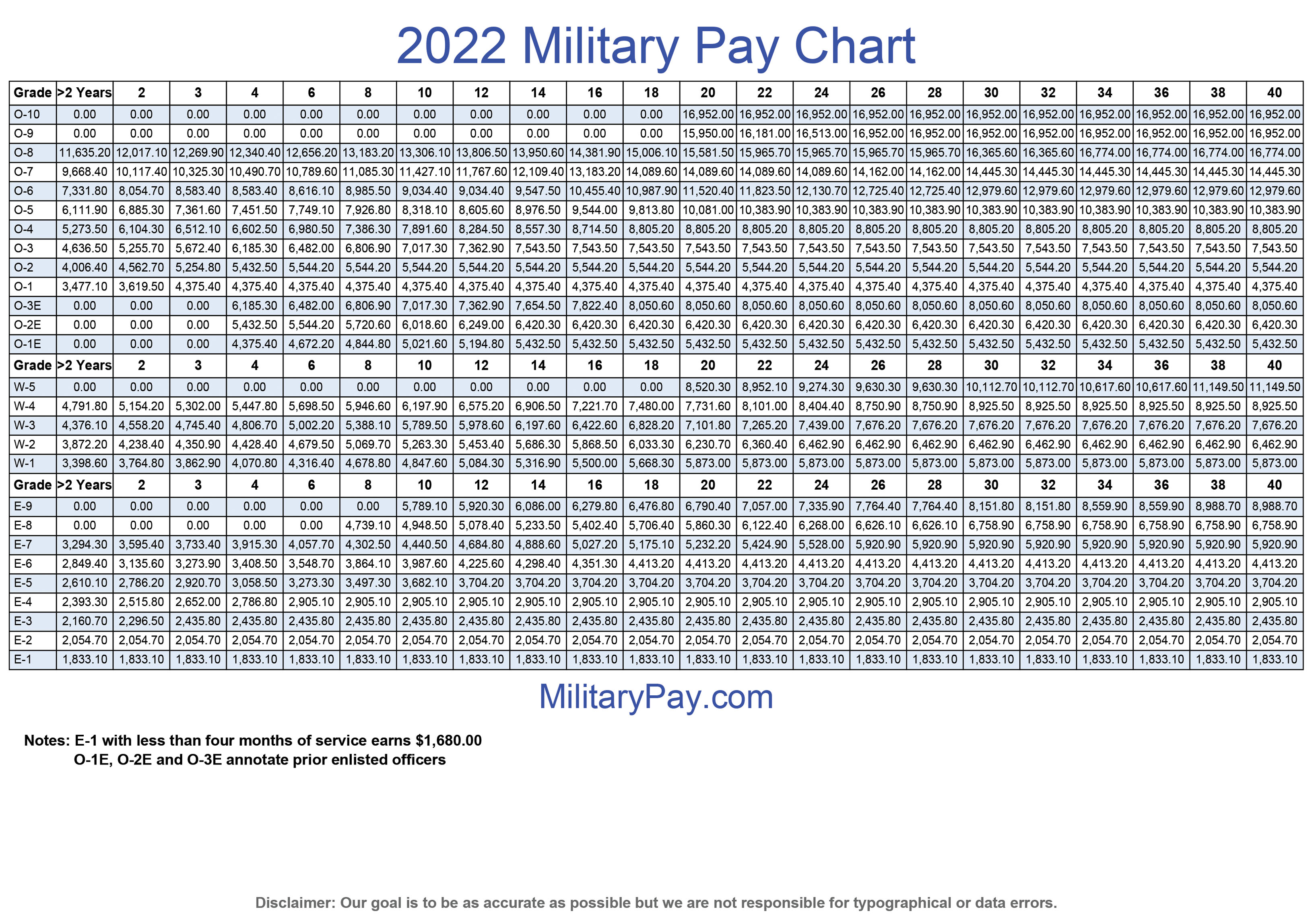

Military retirement benefits are based on a percentage of base salary received prior to retirement from active duty, National Guard, or Reserve service in the military. One of the benefits that make military pension payments so valuable is the built-in Annual Cost of Living Adjustment (COLA).

COLA is tied to the Consumer Price Index (CPI). This is a Bureau of Labor Statistics formula that tracks inflation in the cost of certain consumer goods.

Top 10 Best States For Disabled Veterans To Live(100%)

The final measure determines cost-of-living adjustments for federal pension plans (including military, FERS, and CSRS pensions), as well as COLA increases for Social Security benefits, VA Disability Compensation, and other state benefit programs.

The 2023 cost of living adjustment is 8.7% for Social Security checks, Veterans Disability Benefits, and other public pension and benefit programs.

COLA is increased for Social Security benefits and certain other benefits are automatic. But Congress must pass legislation each year to implement her COLA increases in veteran benefits, including disability benefits, dependent benefits, clothing allowances, alimony, and compensation payments. .

As you can see from this table, there was no annual COLA increase in 2010, 2011 and 2016. Inflation was low at the time. Note that he has a higher COLA rate in years of high inflation, as the purpose of the COLA is to preserve retirement check purchasing power.

The Military's New Retirement Option

If you retire on your military final salary or High-3 pension plan, you must receive the full COLA increase as long as you have been retired for at least one year. If she retires in 2023, she may not receive her full COLA increase as DFAS applies her COLA on a graduated scale to service members retiring during the calendar year.

This is an earlier example of a retired serviceman in 2013 (in 2014 his COLA increased by 1.5%). You can use this as a guide.

A recently retired military member receives her COLA based on the quarter she retired. For example, a person who retired between January 1, 2013 and he September 30, 2013 received her full or partial COLA as follows:

The reduced payment is he one-time and only affects retirees during their retirement year. Retiree will receive her COLA increase in full upon subsequent retirement.

Russia Plans One Off Payments To Military, Retired Ahead Of Election

After 15 years, if you enroll in the $30,000 Career Status Bonus and agree to retire under the REDUX Retirement Plan, you will receive less cost of living adjustments each year. A REDUX retiree receives her COLA 1% below her CPI. In COLA 2023, a REDUX pensioner will see her COLA increase by only 7.7%.

At age 62, he will have a one-time adjustment, and REDUX retiree salaries will be raised to what he was at age 62, barring a reduction in COLA rates. However, after this increase, the annual COLA rate will decrease again.

The measure used by governments is called the Urban Wage and Office Worker Consumer Price Index (CPI-W), but is often referred to simply as the CPI.

The Bureau of Labor Statistics determines CPI by measuring price increases for consumer goods such as food and beverages, housing, clothing, transportation, health care, recreation, education, and communications.

How Big Will The 2024 Military Pay Raise Be?

The government has been exploring several ways to lower her COLA annual pay raises for military retirees and other government benefit recipients.

Ryan Guina is the founder of The Military Wallet. He is a writer, small business owner, and entrepreneur. He served in his USAF more than six years on active duty and is currently a member of the Illinois Air National Guard.

After retiring from active duty military service, Ryan founded The Military Wallet in 2007 and has been writing on finance, small business and military performance topics ever since.

Featured: Ryan's writing has been featured in: Forbes, Military.com, US News & World Report, Yahoo Finance, Reserve & National Guard Magazine (print and online), Military Influencer Magazine, Cash Money Life, The Military Guide, USAA, Go Banking Rates, and many other publications.

Military Cola (cost Of Living Adjustment)

Military wallet

Army national guard retirement pay, army medical retirement pay, army colonel retirement pay, army disability retirement pay, e7 army retirement pay, retirement army pay, army retirement pay chart, us army retirement pay, army retirement pay scale, army officer retirement pay, us army retirement pay chart, army reserve retirement pay

0 Comments